Comprehensive Guide to Financial Markets - 1

A Beginner's Course in Financial Market

FINANCIAL MARKETS - CONCEPTS AND COURSE

Financial markets are the engines driving global economies, providing platforms for trading assets like stocks, bonds, commodities, and currencies. This guide offers a structured introduction to the various types of financial markets, their importance, and how to navigate them effectively. Whether you're an aspiring investor or a finance enthusiast, this course will equip you with the essential knowledge.

What Are Financial Markets?

Financial markets facilitate the buying, selling, and trading of financial instruments, acting as intermediaries between investors and businesses. These markets play a crucial role in capital allocation, liquidity creation, and risk management.

Types of Financial Markets

1. Stock Market (Equity Market)

The stock market allows businesses to raise capital by issuing shares to investors.

Primary Market: Where companies issue new securities (e.g., IPOs).

Secondary Market: Where these securities are traded among investors.

Example: Buying shares on platforms like NYSE or BSE allows investors to own a stake in a company.

2. Bond Market

Bonds are debt securities where investors lend money to issuers (corporations or governments) in exchange for periodic interest.

Type of Bond - Government Bonds or Corporate Bonds Issuer - Federal/State Govt or Private Companies Risk Level - Low or Medium

3. Commodities Market

The commodities market trades natural resources like gold, oil, and agricultural goods.

Hard Commodities: Precious metals, oil, etc.

Soft Commodities: Agricultural products like coffee and sugar.

4. Forex Market

The forex (foreign exchange) market is the largest financial market globally, enabling currency trading.

Key Participants: Central banks, corporations, and individual traders.

Popular Pairs: USD/EUR, USD/JPY. Example: Forex trading helps businesses hedge against currency risk.

5. Cash Market (Spot Market)

In the cash market, transactions are settled immediately, offering instant ownership of assets.

Key Jargon and Economic Terms

Liquidity: The ease of converting assets into cash without losing value.

Hedging: Strategies to minimize potential losses in investments.

Leverage: Using borrowed funds to amplify potential returns.

Importance of Financial Markets

Capital Formation: Enables businesses to secure funding.

Wealth Creation: Offers individuals opportunities for investment and growth.

Price Discovery: Reflects the real-time value of assets.

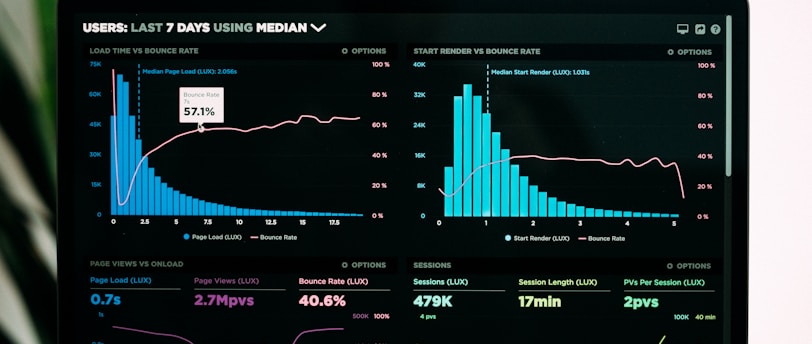

Graph: A line graph comparing the performance of equities, bonds, and gold over a decade.

How to Get Started in Financial Markets

Learn the Basics: Understand the instruments and market dynamics.

Diversify: Spread investments across multiple asset classes to reduce risk.

Seek Advice: Consult financial experts for tailored strategies.

Conclusion

Understanding financial markets unlocks a world of opportunities, from building personal wealth to supporting global economic growth. Dive into these markets to make informed investment decisions and secure your financial future.